Which of the Following Federal Forms Reports Depreciation

When you rent property to others you must report the rent as income on your taxes. The Indiana Department of Revenue requires taxpayers to report adjustments on Schedule 1 or B for differences in depreciation amounts claimed on the federal tax return and depreciation amounts allowable on the Indiana tax return.

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

To review or print the Depreciation Summary in the TaxAct program.

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

. For example an item with. Information from the asset module federal Form 4562 the Indiana 4562 worksheet and the federal K1-St screen calculates the depreciation. Go to File Print Preparer Reports.

080 points What is the tax liability for an individual with 52000 of income which includes 2000 of dividends if the tax rate is 15 percent on income up to 25350 and 28 percent on income over 25350. The four most important financial statements provided in the annual report are the balance sheet income statement cash budget and the statement of retained earnings. A separate federal AMT depreciation report is also prepared on an asset by asset basis to support alternative minimum tax depreciation computations.

Many expenses can be deducted in the year you spend the money but depreciation is different. In the Report selection section select Federal Elections. If there are multiple assets subject to the depreciation bonus report the total cost of these assets.

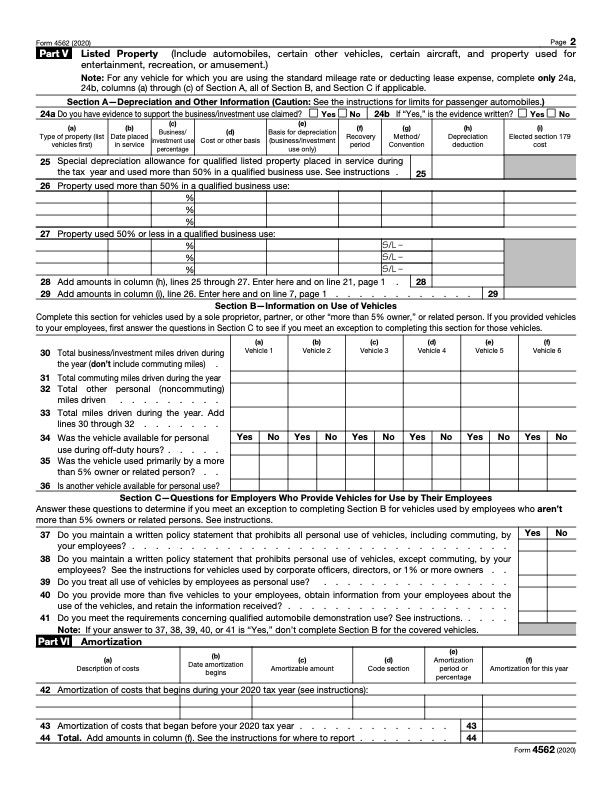

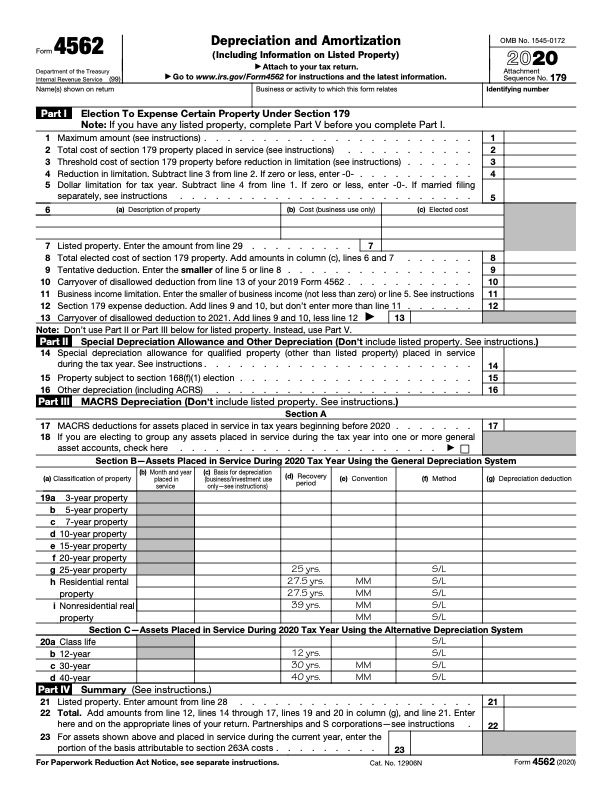

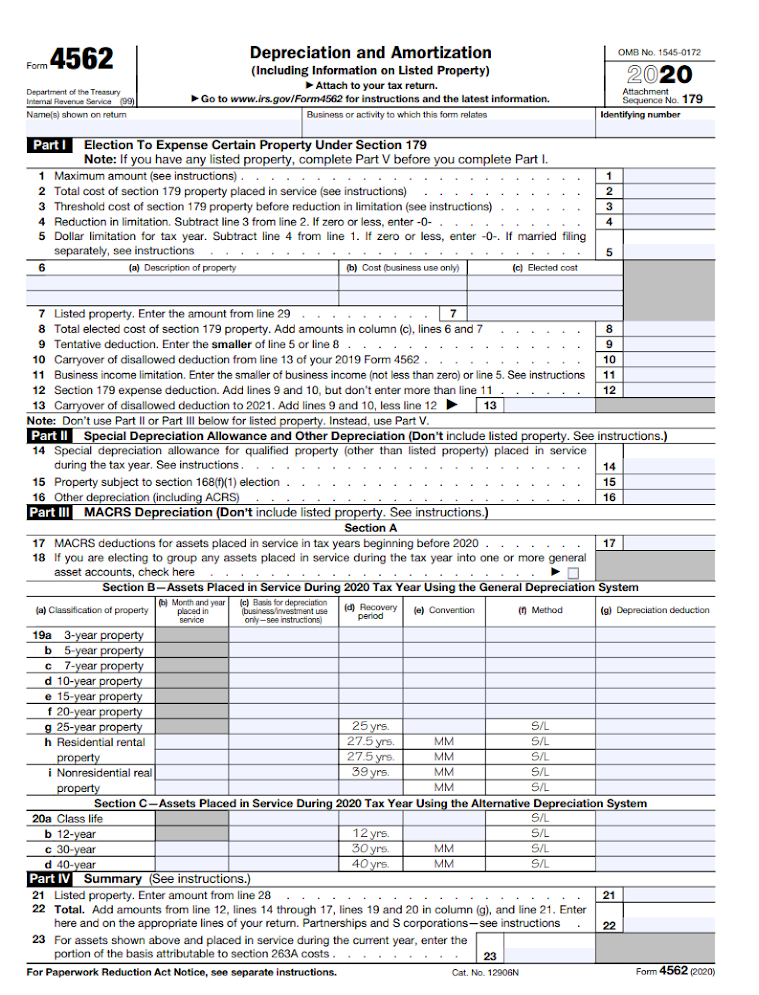

The depreciation total is then divided by the assets useful life as determined by the Useful Life Schedule. O The more depreciation a firm reports the higher its tax bill other things held constant. Depreciation and Amortization is an Internal Revenue Service IRS tax form used to depreciate or amortize property purchased for use in a business.

Consider a piece of equipment that costs 25000 with an estimated useful life of 8 years and a 0 salvage value. Which of the following statements is CORRECT. To begin please take the following path within the program.

The federal Class Life Asset Depreciation Range ADR System provisions which specifies a useful life for various types of property. To view the election do the following. The maximum federal tax rate on personal income in 2008 was 50.

Depreciation is determined using this formula. In Box 30 - Type of depreciation code see help use the lookup feature double-click or click F4 to select option 4 - Section 168k property. FASB Financial Accounting Standards Board.

SEC Securities and Exchange Commission C. O People sometimes talk about the firms net cash flow which is shown as the lowest entry on the income statement hence it. Which of the following are required to file annual reports with the securities and exchange commission.

The 75000 represents 100 of her share of the basis in the. The tax depreciation is based on the regulations of the Internal Revenue Service IRS. On the depreciation screen you will see the following entry options.

IRS Internal Revenue Service B. Of the following forms of organization which businesses are the greatest in numbers. 080 points Which of the following forms of income can individuals defer from taxation.

Multiply that number by the assets depreciable value. The tax regulations specify the useful life of assets but also allow for accelerated depreciation or the immediate expensing of certain amounts on some companies tax returns. Once youve calculated depreciation you must complete Form 4562 to claim your tax deduction for each asset.

Which of the following statements is CORRECT. Accounting depreciation also known as a book depreciation is the cost of a tangible asset allocated by a company over the useful life of the asset. Depreciation Expense Cost Salvage value Useful life.

If the assets depreciable value is 10000 the first years depreciation is 3333 515 x. Kelly uses this amount when filing her federal return. However California law does not allow the corporation to choose a depreciation period that varies from the specified asset guideline system.

Use form FTB 3885A Depreciation and Amortization Adjustments when reporting a difference. If youre uncertain about the amount of tax depreciation and how to accurately report it its best to consult a. California law does not conform to federal law for the following.

Depreciation Expense 25000 0 8 3125 per year. There is also a disposal summary available. In the Options section select View report.

These reports are available for the current year and the information is also provided for the following five years depreciation amounts. Depreciating and amortization are detailed by businesses in IRS Form 4562 which you type in when you want to reduce a bonus. TaxAct provides depreciation reports for federal and state returns.

Depreciation Total Asset Value - Salvage Value - Federal Amount Utilization. By using the formula for the straight-line method the annual depreciation is calculated as. Tax depreciation refers to the amounts reported on the companys income tax returns and in the US.

946 How to Depreciate Property State Revenue and Taxation Code RTC Section 17250 FTB Pub. 1001 and FTB 3885A. A federal depreciation and amortization detail report is prepared on an attachment entity basis for all assets to support the regular tax depreciation computations.

For tax year 2021 she received federal Schedule K-1 from Capital T showing her share of bonus depreciation in the amount of 75000. The form 4562 uses Form 4562 which can be altered to reflect bonus depreciation. Remember that depreciation is a non-cash item.

This form should be filed with your tax return. Which of the following is the federal independent agency that provides oversight of public companies to maintain fair representation of company financial activities for investors to make informed decisions. This means the van depreciates at a rate of 5000 per year for the.

Rarely does an activity include salvage value but if it does it can be up to 10 of the asset value. None of the above-treasurer chief financial officer controller. But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation.

Federal IRS Pub. The depreciation expense per year for this equipment would be as follows. The recognition of accounting depreciation is driven by accounting standards and principles such as US GAAP.

Profit or Loss From a Business Schedule C OR Profit or Loss from Rentals and Royalties Schedule E Edit or Add Schedule CE. 35000 - 10000 5 5000.

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

0 Response to "Which of the Following Federal Forms Reports Depreciation"

Post a Comment